Saudi Arabia’s sovereign wealth fund, the Public Investment Fund (PIF), has secured the 5th spot among global investment organizations. A recent report indicates its net assets have reached a staggering $861 billion. This positions PIF well on track to achieve its $1 trillion target by 2025, a move aimed at diversifying the Saudi economy.

A key factor in this growth is PIF’s acquisition of an additional 8% stake in Aramco, the national oil giant. This strategic move increased PIF’s shareholding in Aramco to an estimated value of $328 billion, significantly impacting the fund’s total assets. PIF’s holdings have now surpassed $860 billion, reflecting a substantial jump from $700 billion at the end of 2022.

The Aramco stake plays a crucial role, contributing roughly 37% of PIF’s portfolio value. This not only marks a significant milestone for the fund but also underscores its central position in Saudi Arabia’s economic diversification strategy. The substantial Aramco stake is expected to generate billions in annual dividends for PIF, further bolstering its investment capabilities.

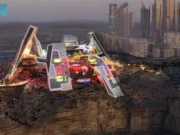

Beyond Aramco, PIF actively participates in various large-scale projects and subsidiaries that fuel Saudi Arabia’s Vision 2030 goals. This includes establishing Alat, a $100 billion industrial electronics giant aiming to strengthen the global semiconductor supply chain and contribute significantly to the nation’s GDP.

PIF’s ventures in the automotive sector, including partnerships with Hyundai and investments in Lucid and Ceer Motors, further demonstrate its commitment to positioning Saudi Arabia as a major player in the global automotive industry.