Saudi Arabia is taking significant steps to boost its tourism sector and enhance its competitiveness with neighboring Gulf countries. In late August, the Zakat, Customs, and Tax Authority initiated a public consultation on proposed changes to tax regulations. These changes are designed to improve compliance with value-added tax (VAT) laws and provide relief to certain VAT payers.

While Saudi Arabia does not levy personal income tax, excise duties were introduced in 2017, and VAT was increased to 15 percent in 2020 from 5 percent when it was first implemented in 2018.

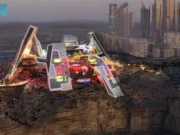

The new tourist refund scheme is part of the government’s broader strategy to increase tourism’s contribution to gross domestic product (GDP) to 10 percent by 2030. This initiative follows the recent suspension of licensing fees for hotels, hotel apartments, and resorts. Saudi Arabia aims to attract 50 million religious tourists annually by 2030.

To further stimulate economic growth, Saudi Arabia is also planning to simplify foreign investor registration starting in January. This move is expected to boost foreign direct investment figures. The Capital Markets Authority is also considering eliminating the 5 percent withholding tax on interest payments to corporate bondholders.

Currently, non-GCC investors in Saudi Arabia face a 20 percent corporate income tax, which can rise to at least 50 percent for oil and hydrocarbon producers. These tax reforms are crucial for attracting foreign investment and enhancing Saudi Arabia’s position as a global tourism destination.